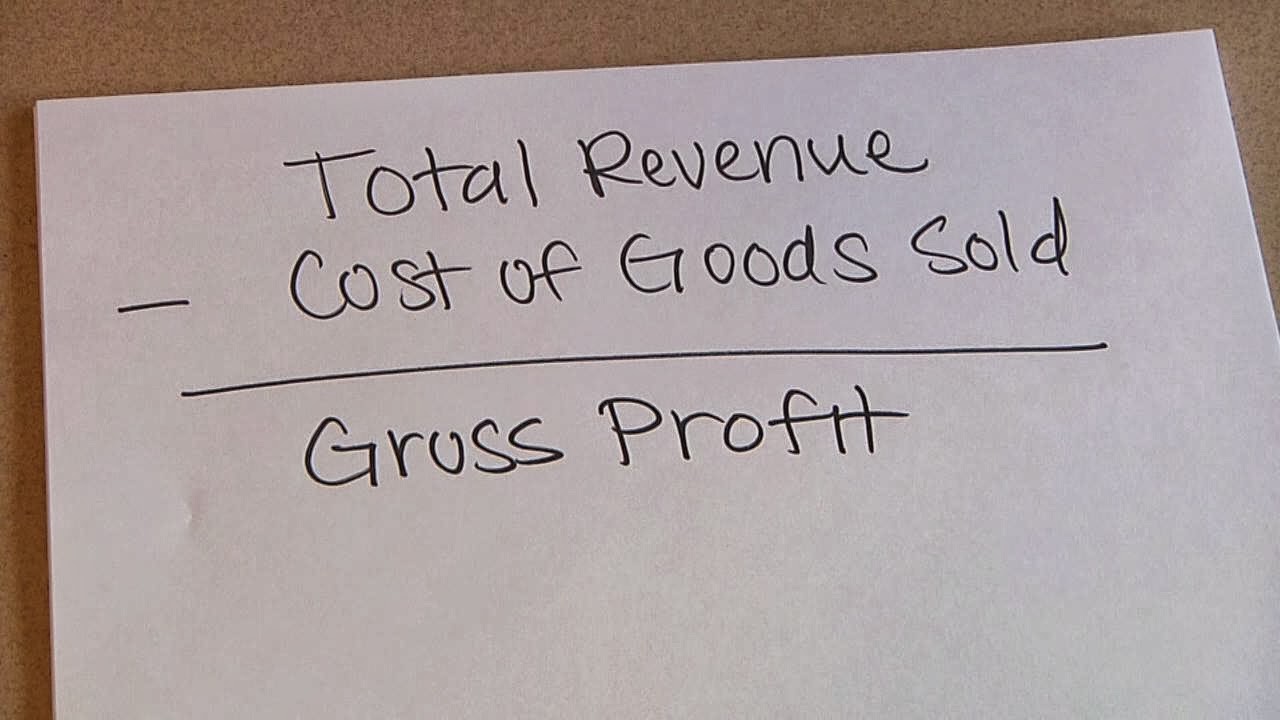

According to Sec. 4, the gross profit derived by an employer form an establishment in respect of any accounting year shall.

(a) In the case of a banking company, be calculated in the manner specified in schedule

(b) In any other case, be calculated in the manner specified in schedule II.

ADVERTISEMENTS:

(c) Any exemption conferred in the employer u/s 84 of the Income Tax Act or of any deduction to which he is entitled u/s 101 (1) of I.T. Act as in force immediately before the commencement of the Finance Act 1965.

(d) Where the employer is a religious and charitable institution to which the provisions of Sec. 32 do not apply and the whole or any part of its income is exempt from tax under Income Tax Act. then with respect to the incomes so exempted, such institution shall be treated as if it were a company in which public are substantially interested within the meaning of that Act;

(e) Where the employer is an individual or a Hindu Undivided family, the tax payable by such employer under the Income Tax Act shall be calculated on the basis as if the income derived by him from the institution were his only income.

ADVERTISEMENTS:

(f) Where the income of any employer includes any profit and gains derived by him from the export of any merchandise out of India and the employer is allowed any rebate on such income under any law relating to direct taxes, then, no account shall be taken of such rebate.

(g) No account shall be taken of any rebate (other than development rebate or Investment allowance or development allowance) or credit or relief or deduction in the payment of direct tax allowed under any law relating to direct taxes or under the relevant Finance Act, for the development of any industry.