Gross profit or accounting profit is the surplus left with the entrepreneur after all explicit costs have been paid out, as recorded in the books of accounts.

For an accountant, the opportunity costs are subjective. These costs are ignored, as they cannot be accurately measured. An accountant is interested in accounting, auditing, planning and budgeting profit. He does not take care of implicit or opportunity costs.

ADVERTISEMENTS:

On the other hand, economists are very much concerned with the opportunity costs. As every decision involves a sacrifice of alternatives, opportunity costs are implied in every business decision. These implicit costs are taken out from the accounting profit to get economic profit.

In other words, economic profit is less than accounting profit by the amount of opportunity cost. For large corporations with separate ownership and management, implicit costs are almost nil resulting in zero economic profit.

There may be economic loss inspire of accounting profit, if the magnitude of opportunity cost exceeds accounting profit. Thus, net profit or economic profit is the surplus left after meeting all costs including imputed costs. Economic profit alone reflects the true profitability of the business.

In brief,

ADVERTISEMENTS:

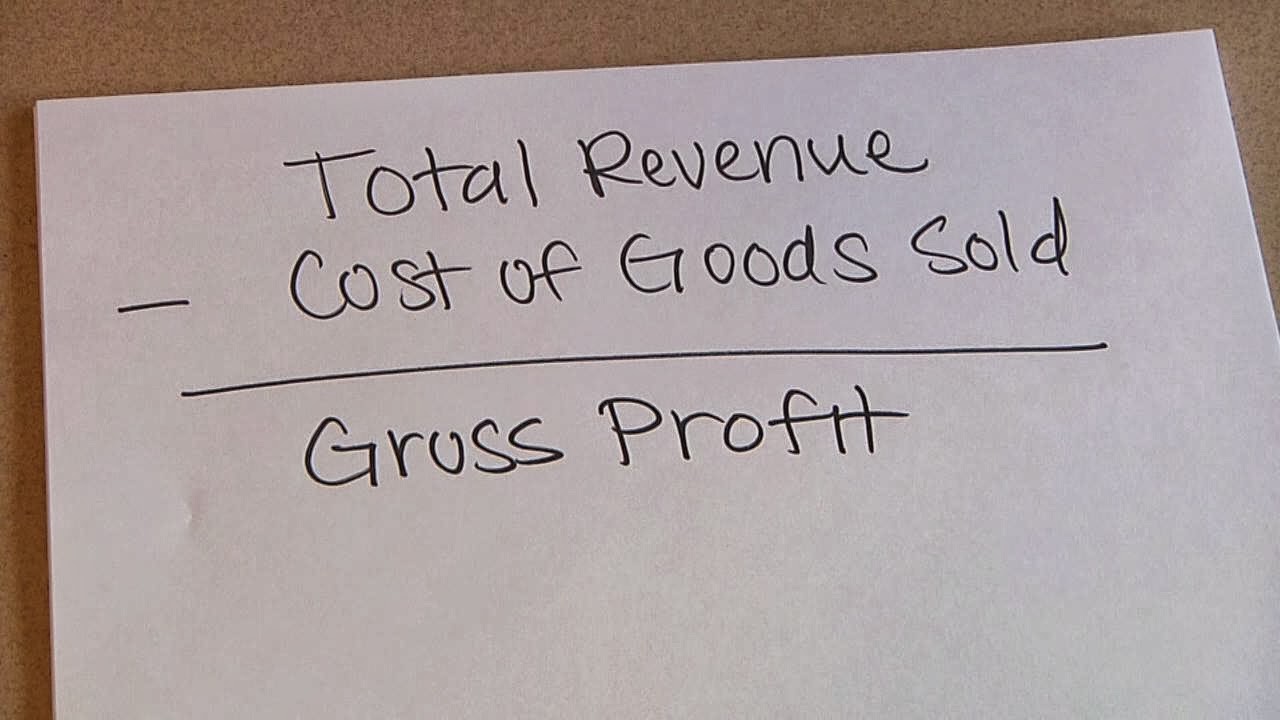

Gross Profit (Accounting Profit) = Total Revenue -Explicit Costs

Net Profit (Economic Profit) = Total Revenue – (Explicit Costs + Implicit Costs)

= Gross Profit – Implicit Costs

Or, Gross Profit = Net Profit + Implicit Costs

ADVERTISEMENTS:

Thus, gross profit contains a part of net profit. Zero net profit implies that the total revenue of the firm is just sufficient to cover not only costs incurred on hired factors, but also the opportunity cost of owner’s own resources, known as normal profit, to which we now turn.