Indirect taxes are not an unmixed blessing. There are a good number of demerits which are listed below:

1. Inequitable and Regressive:

Indirect taxes fall more heavily on the poor. So it is regressive in character. In case of indirect taxes, rich and poor are taxed at the same rate. Indirect taxes on essential commodities hurt more to the poor people than to the rich.

More burdens will be borne by the poor than by the rich. So indirect taxes are regressive, inequitable and unjust and do not satisfy the canon of equity.

2. Uncertain:

ADVERTISEMENTS:

Indirect taxes do not satisfy the canon of certainty. As we know, the demand for necessaries is inelastic and demand for non-necessaries is highly elastic. Poor people use necessaries (necessary for existence). Poor people cannot reduce its consumption even if there is a rise in the prices of necessaries due to imposition of indirect taxes.

On the other hand, rich people can reduce the consumption of non-necessaries (or luxuries) when there is a rise in prices of non- necessaries due to imposition of indirect taxes. Huge revenues are collected through the imposition of indirect taxes but it is hardly possible to know whether rich people contribute more to the total revenue or poor people contribute more to the total revenue.

Usually indirect taxes affect the poor more. Thus, these taxes are highly uncertain and hence a poor guide to the budget making exercise of the government.

3. Unreasonable price rise:

ADVERTISEMENTS:

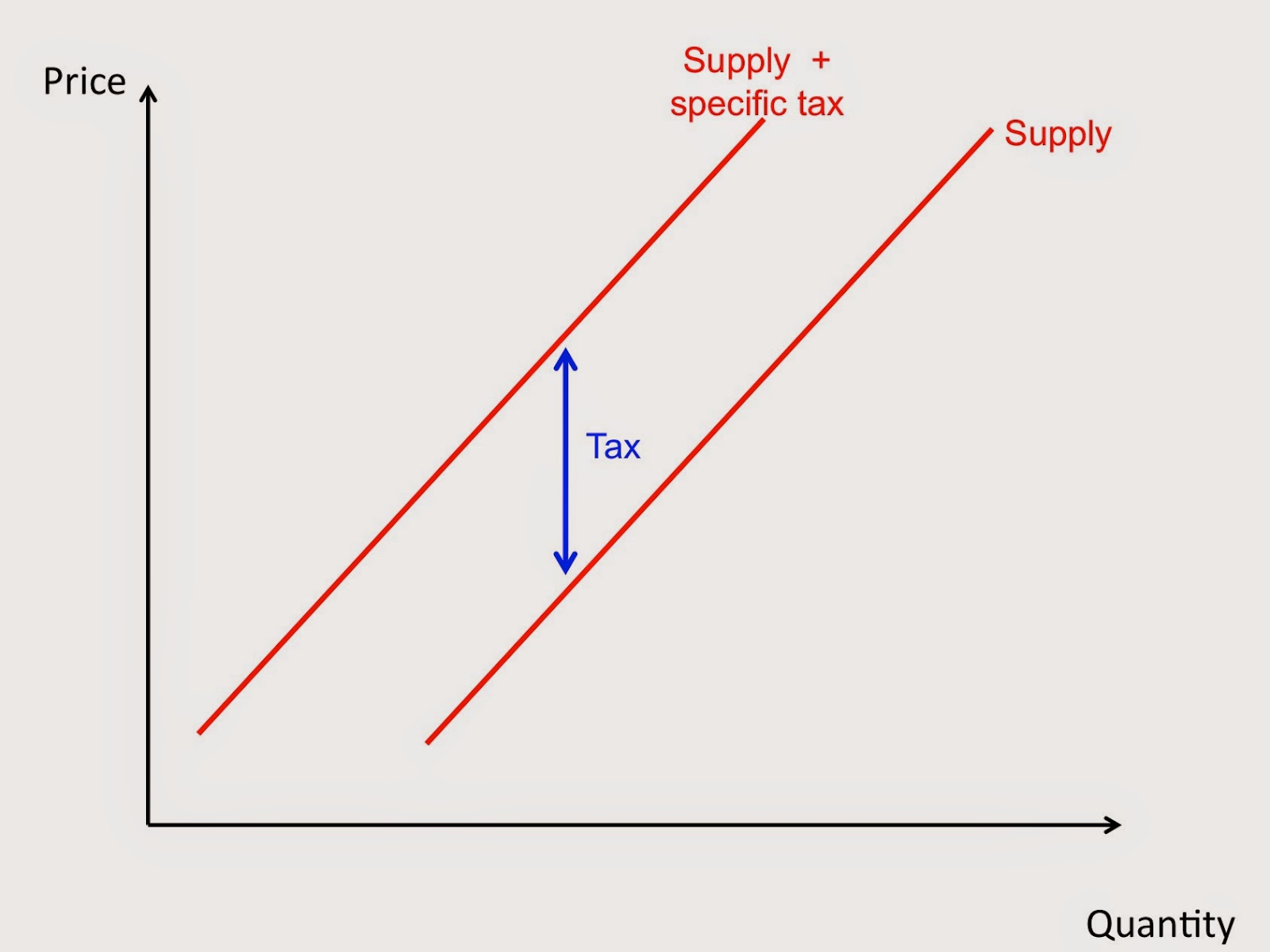

Indirect taxes raise prices. But the price should rise by the exact amount of tax only. In practice, we find that the buyers pay prices by larger amount than the tax. Dishonest sellers can easily cheat the buyers by charging larger amount than the actual tax.

4. Uneconomical:

Indirect taxes are collected from the producers, wholesaler, shopkeepers, exporters, importers etc. So every source of tax yield has to be properly guarded. So, huge staff has to be maintained to check accounts, to detect smuggling, to prevent unlicensed production etc. So the cost of collection of indirect tax is very high.

5. Lack of Civic Consciousness:

Indirect taxes are unable to develop civic consciousness. Many people do not know that they pay indirect tax along with the prices. People do not feel the pinch of tax payment.

As the tax payment is not apparently felt, the tax payers do not take interest in ‘how they are spent’. So, indirect taxes are unable to create consciousness among the tax payers.

6. Inflationary:

ADVERTISEMENTS:

Indirect taxes are paid along with the prices. These taxes raise the prices of different commodities. It has a chain reaction. Wage rates increase due to the rise in prices of commodities. Wage-price spiral starts.

The cost of production of commodities rises which in turn leads to rise in prices of commodities. This leads to general rise in prices of commodities (general rise in prices is known as inflation).

7. Fall in Consumption:

Indirect taxes are included in prices. So, indirect taxes raise the prices of commodities. The consumption of lower income groups is bound to fall because of rise in prices of commodities. Fall in the consumption of essential commodities worsens health and efficiency of the masses.